Business News

Buy to Let Landlords - Mortgage Changes Start to Bite

03/07/2018

We are now well under way with the preparation of self-assessments for the 17/18 tax year.

Many of our clients own properties that are rented out and as the final calculation of tax owed (or if you are very lucky tax owed back to you!) pops up onto the screen it becomes clear just how much the change to mortgage interest rate relief is starting to impact.

The summer budget of 2015 was when the Chancellor at that time, George Osbourne, announced some sweeping revisions for buy to let landlords but there has been a long period between the announcement and the actual implementation. For those that have not planned or have understandably forgotten the detail, it has been somewhat of an unpleasant wake-up call. The situation is likely to worsen over the next few years so it’s worth analysing again what is happening.

The 17/18 tax year is the first year when the erosion of mortgage interest rate relief starts to take effect. The changes will only affect higher rate tax payers, unfortunately that is probably the majority of our ‘landlord clients’. In 17/18 tax year you will only be able to claim 75% of any mortgage or loan costs as a tax-deductible expense against rental income. To soften the blow, you will receive a credit against your final tax bill – the credit is calculated using the remaining 25% of unclaimed mortgage/loan costs. I know this sounds a little bit confusing so let me explain using some easy figures:

If your mortgage interest was £1,000 you can only claim 75% against rental income so £750. HMRC then takes the remaining £250 and gives you a 20% tax credit calculated on this amount so 20% x £250 = £50, i.e. you get £50 off your final tax bill (not a massive softening of the blow!).

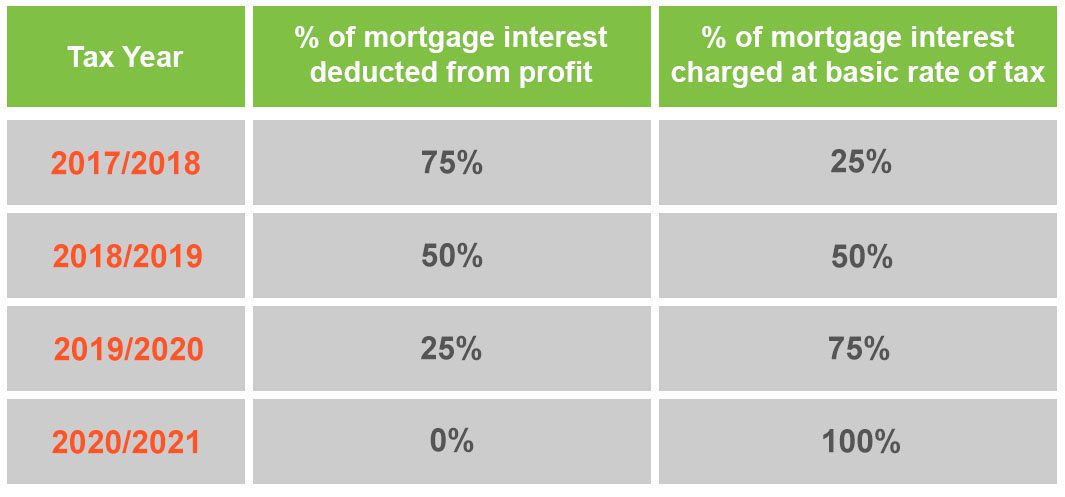

The ability to claim any mortgage interest relief is being eroded gradually until 2020/2021 when all financing costs incurred by a landlord will be given as a basic rate tax reduction. The following table shows the reduction in mortgage interest rate relief and the increase in the percentage of mortgage interest used for the tax credit.

At Carrington Accountancy we offer a comprehensive service which clearly evaluates how you will be affected both now and over the next few years. We will explain the options available as well as the pros and cons of these options. If you would like to know more about this service, please get in touch with nicky.owen@carringtongroup.co.uk or jmumford@carringtongroup.co.uk.